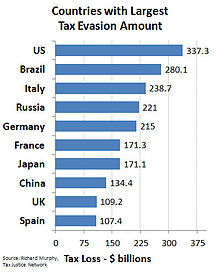

In the world. In total, global tax evasion amounts to between 21,000 and 32,000 billion dollars, equal to the GDP of the United States, Japan and Germany combined. With such sums, available for investment, and to create jobs, many problems could be solved, all over the world.

In the world. In total, global tax evasion amounts to between 21,000 and 32,000 billion dollars, equal to the GDP of the United States, Japan and Germany combined. With such sums, available for investment, and to create jobs, many problems could be solved, all over the world.

In words, anyone is against tax evasion. In fact, anyone, even in a not entirely voluntary way, has done tax evasion in his life, and engaged in unethical behavior.

Often on social media, many people in difficulty, unload their frustrations, against those who have more fame and wealth than them.

Many are champions of justice, and give demonstrations of justicialism, against those who evade taxes. Not thinking, however, that every time they take a coffee, or buy a product, or pay for a service, without requiring a receipt or an invoice, they commit the same "sin", in exactly the same proportion. But basically, if simple people knew how to understand the proportions, much, and useless, social hatred, would be avoided. A company, with a profit of 1000000 dollars, which for example would have to pay 15% of taxes, therefore 15000 dollars, and pays only 142500 dollars, evades 5%, which is 7500 dollars. If a regular citizen, for example, takes a $ 1 coffee and does not ask for an invoice, he evades the payment or combined tax in the United States, which in some countries is called value added tax, or value tax, which in almost the whole world varies, but in the United States, in Arkansas it is 6.50%. If you do the calculations, on how many coffees you take, every day in the world, if nobody paid us taxes, on these payments, there would be a lot less money, for local communities, therefore for citizens.

But let's take a final example, to better understand. How many times do you change an appliance, or call a technician for a repair, and the sentence we are told is: with an invoice or without an invoice? And if we ask, what's the difference? They tell us, with an invoice, to the 100 dollars, I must also add the payment tax, and it will cost you 106.50 dollars. And we, in order not to pay more, pay only 100 dollars.

Many such "operations", by many people, for several years, accumulate enormous sums, not of individual savings, but of lost income for the country, the state, or local authorities. And all this translates into fewer services, and less aid for those in need.

Now that we understand the problem, let's look for solutions together.

The first solution is to change the mentality of all people, it is complicated to put into practice, difficult to implement, but if implemented, it costs absolutely nothing.

The second solution is to include civic education and ethical education, already from primary schools, teaching young people, but also to those who are not so young (doing courses for everyone), how important is the respect for things, which is obtained with respect for people.

The third solution, to make laws to prevent any type of tax evasion, being very careful, to those who register goods to other people, to evade taxes.

The fourth solution, to punish the guilty, not only with prison, but with the confiscation of all assets, and with the limitation of certain rights. It's bad to hear, but if a sick person dies due to tax evasion, resulting in a lack of funds, even the aggravating circumstance of complicity in manslaughter could be used. Are we too strict? Anyone who thinks we are, tell the family of the dead person, or all the families of those who die, because they don't secure their homes, to try to prevent disasters, and the examples could go on.

The fifth solution, which is linked to our other projects, is to increase controls, including preventive ones, using specialized personnel, and all the best technologies.

The sixth solution is to use the same cunning with cunning people. We have articles, in which we will explain, how to check, to do justice.

The seventh solution is to create a single world taxation, eliminating tax havens, and the differences between countries, in the tax system, between different countries, states, and at the local level.

The eighth solution is to eliminate the corruption of those who have the task of controlling. Again, we have dedicated articles, with many explanations.

The ninth solution is, in addition to punishing, recovering all the sum evaded, by all possible means, and where this is not possible, making the guilty person work, until full payment, of the sum evaded and the accumulated interest.

The tenth solution is not to give discounts to those who evade, if they pay back a percentage, of what is evaded. You have to pay for everything with interest, and not favor the criminals. Otherwise decent people, who are in good standing, and respect the law, will be tempted to try to copy criminals, feeling, rightly, made fun of and underdogs.

The eleventh solution, thanks to technology, consists in the use of electronic payment systems, which must be close to 100%, with the aim of completely eliminating cash. This will allow significant savings, lowering, to the point of almost eliminating the cost of money, with significant benefits for all of us. Less waste of paper, plastic (in some countries), metals, to create money, which create environmental damage. But we will talk about it in our ideas, of money, finance, and economics

The twelfth solution, linked to the eleventh, provides for the traceability of each operation, and the comparison of data, with the collaboration of all.

The thirteenth solution, completely eliminate all illegal activities, public and private corruption, and all kinds of crime.

Anyone who contests even just one of our solutions is in bad faith, because if one is in good standing, and respects all the laws, he should have nothing to fear.

Many will tell us, that they are good ideas, but difficult to achieve, but with a little work, they can all be realized, with considerable benefits for everyone, except for those who think they are smarter than others, and do not respect the law.

a. To accept full responsibility for the comment that you submit.

b. To use this function only for lawful purposes.

c. Not to post defamatory, abusive, offensive, racist, sexist, threatening, vulgar, obscene, hateful or otherwise inappropriate comments, or to post comments which will constitute a criminal offense or give rise to civil liability.

d. Not to post or make available any material which is protected by copyright, trade mark or other proprietary right without the express permission of the owner of the copyright, trade mark or any other proprietary right.

e. To evaluate for yourself the accuracy of any opinion, advice or other content.